Mexico to launch its digital currency by 2024

Government announces that the Bank of Mexico is planning to launch a government-backed digital currency by 2024.

3rd of January 2022

Mexico: Government announces that the Bank of Mexico is planning to launch a government-backed digital currency by 2024. The central bank cites, it is significant to leave the old one and utilize new payment technology.

The Mexican government provided the information via Twitter. The tweet done in the Spanish language cites that it is an essential move. The new technologies & state-of-the-art payment infrastructure will deliver significant value to advance financial addition in the nation.

Bank of Mexico has started its research study of a digital currency in several phases. Data gathered from the study will further be a base for the current electronic payments system to expand payment options beneath a rapid, safe & efficient framework.

Officials of the Bank are already in talks with the financial institutions regarding the infrastructure required in order to launch the digital currency and how the currency could be implemented efficiently.

Bank of Mexico governor Alejandro Díaz de León, while speaking during an event of International Monetary Fund, previous year in the month of July, asserted that “The Central banks require to move quickly to develop new forms of money and comprehensively operable digital currencies amid growing use of crypto investments and the risks they entail”.

Several other nations around the globe are also planning to bring and implement digital currencies after El Salvador announced Bitcoin as its legal tender.

Banxico’s deputy governor, Jonathan Heath, in a recent video conference, noted, “We are going to have the utilization of paper money as the preponderant payment domestically for a long time, so we do not want to be absent from these technological advances”.

Benefits of Digital Currencies:

As payments are made in digital currencies are assembled directly between the transacting parties without any intermediaries, the transactions are usually quick and low-cost.

This fares reasonably compared to traditional payment methods that involve banks or clearinghouses.

Latest

- St. Kitts and Nevis hosts 50th CARICOM Heads of Government Meeting

-

Dominica: Parliament reviews five key bills to strengthen healthcare and governance -

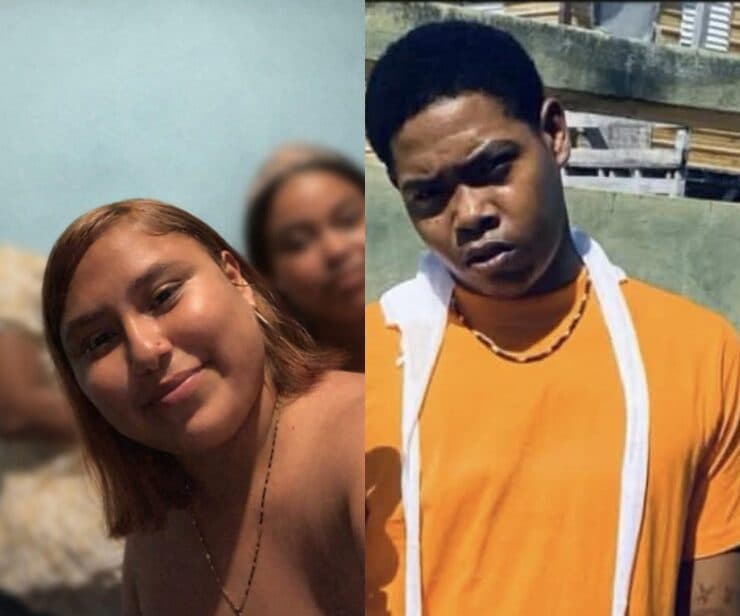

Trinidad and Tobago: Guyanese gardener kidnapped and taken to Venezuela -

Saharan Dust surge triggers Air Quality alert in Antigua and Barbuda -

PM Terrance Drew confirms over 95% of CARICOM Leaders to attend 50th Summit

Related Articles

25th of February 2026

24th of February 2026

24th of February 2026

23rd of February 2026

23rd of February 2026

22nd of February 2026