Trinidad and Tobago’s 2024 Budget: A Balanced approach amid Global challenges

Across nearly five-and-a-half hours in the presentation, Imbert mentioned that it is “a deliberate decision to not up or lower existing taxes.”

1st of October 2024

In an impressive display of fiscal conservatism, Finance Minister Colm Imbert presented Trinidad and Tobago‘s budget for 2024, totalling TT $54.01 billion (US $8.6 billion).

Across nearly five-and-a-half hours in the presentation, Imbert mentioned that it is “a deliberate decision to not up or lower existing taxes.” This perhaps could be an attempt to stabilize the economy, given the volatile nature of the global energy market.

Fiscal Health and Economic Stability

The budget has total expenditures of TT $59.2 billion, which would result in a fiscal deficit of TT$5.197 billion, that is about 2.7% of gross domestic product (GDP). This remains well within the internationally recognized benchmark of 3%, indicating that the government maintains keen interest in ensuring fiscal discipline.

This is pertinent because oil and gas revenues faced by Trinidad and Tobago have been quite volatile since the 1970s. According to Imbert, it is essential that assumptions on the predicted oil price, at US $85 per barrel, are critical for budget formulating.

Emphasis on Social Welfare

This budget is based on social welfare and protecting the country’s most vulnerable citizens. Key ideas include raising the minimum wage by 17%, which would see the rate move from TT $17.50 per hour to TT $20.50 per hour.

This would likely support about 190,000 workers and would be a positive step towards improving living standards generally, but especially amongst those at the lower end of the income scale.

In a further step to social equity, Imbert disbursed TT $1 billion for backpay for 37,000 public sector workers. The package includes a four percent wage increase and is exempted from one-time TT $4,000 payment made for the retirees from taxation. Thus, it is an approach to the relief of public servants with recognition to their contributions.

Boosting Economic Growth

To boost the economy, the government has extended the Tourism Accommodation Upgrade Project for three years and continued to introduce exclusions from business levies to manufacturing companies as long as they sell their products overseas.

These provisions would enhance the competitiveness of local industries among many others and streamline international trade, which would be a fundamental requirement to ensure diversity in the economy.

This bill also contains a Cybersecurity Investment Tax Allowance. That is an opportunity for companies to invest in cybersecurity measures and receive a tax allowance up to TT $500,000.

This initiative, together with a 150% tax allowance for corporate sponsorship of registered public and private schools, demonstrated a commitment to innovation and educational betterment.

Addressing Crime and Public Safety

Other notable allocations are made to strengthen law enforcement powers amid growing anxiety over public safety issues.

According to Imbert, the government intends to increase police funding for their resources, including equipment and vehicles, and conducting a recruitment campaign. In this effort, the people have further gained an impression that authorities are proactive in dealing with crime that instils confidence in the minds of citizens regarding their safety.

Overall, this budget presents a balanced means of addressing current social equity concerns while building the foundation for economic growth and stability.

Imbert’s commitment to maintaining current tax structures, combined with targeted social investment and incentives in those sectors that really matter to sustain growth, illustrates a very strategic vision for Trinidad and Tobago as it navigates these complexities of globalization.

As soon as the debate on budget begins, each of the stakeholders in the country would examine these proposals and their probable impacts.

Latest

- West Indies cricket team to return home after travel disruption in India

-

Foreign Minister Denzil Douglas calls for stronger voice for small island states at Commonwealth retreat in London -

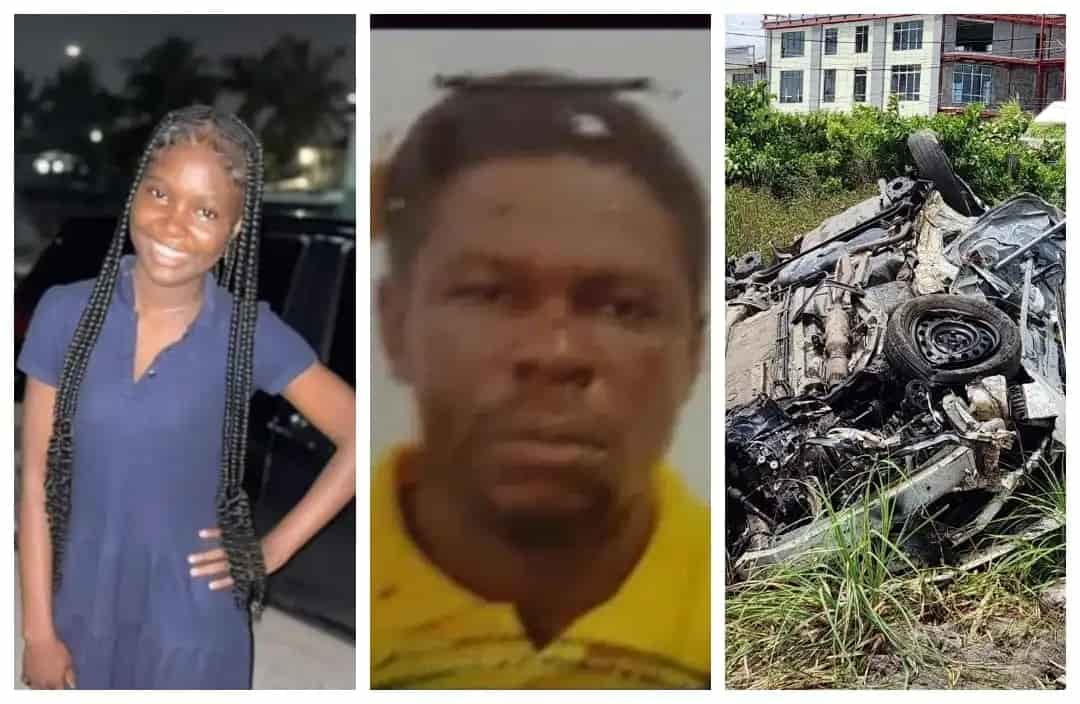

Jamaica: Dacia Forrester dies after being set on fire in gas station dispute -

Four men robbed and assaulted while catching bullfinches in Trinidad -

West Indies Women to face Australia in six-match series ahead of T20 World Cup

Related Articles

9th of March 2026

8th of March 2026