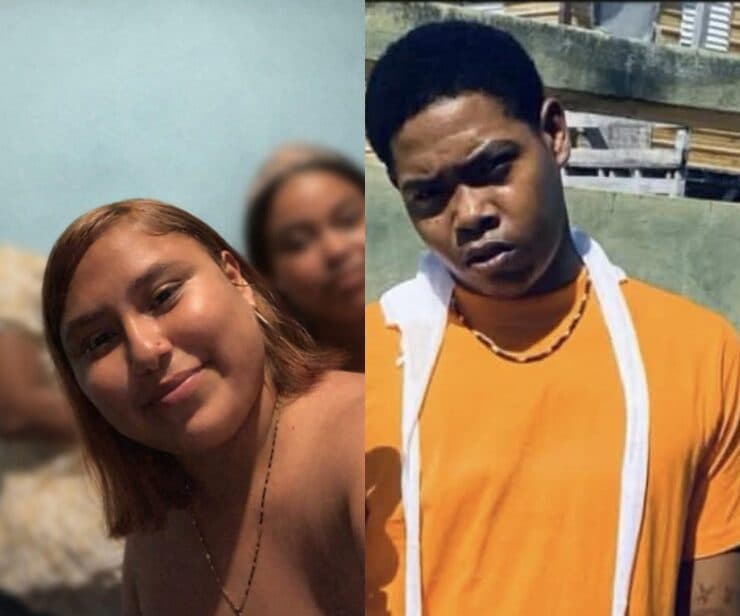

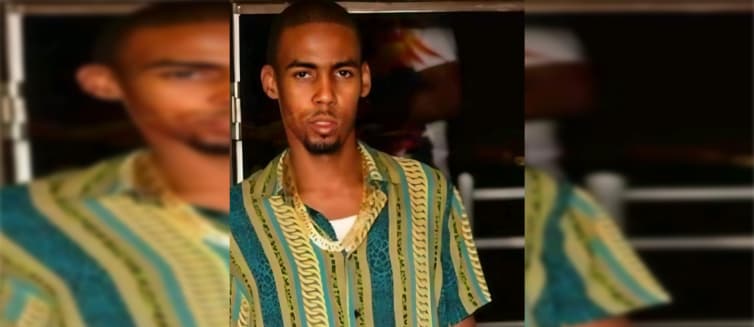

Dave Dowrich to assume office as new CFO of TIAA from 1 November

Dave Dowrich is now the new CFO of TIAA, a Trillion dollar firm and a leading North American investment firm. TIAA has its headquarters in New York and has over US$1.3 trillion in assets under management & last year had more than 16 000 employees; the company announced recently that Dowrich would be appointed as its Chief Financial Officer.

10th of September 2021

Barbados: Dave Dowrich is now the new CFO of TIAA, a Trillion dollar firm and a leading North American investment firm. TIAA has its headquarters in New York and has over US$1.3 trillion in assets under management & last year had more than 16 000 employees; the company announced recently that Dowrich would be appointed as its Chief Financial Officer.

Dowrich will take up the new position in the New York head office from November 1, 2021.

Dowrich, who was the former chief financial officer (CFO) at Prudential Financial and interim chief executive officer of International Life and Retirement, was CFO of AIG Japan and the Asia Pacific, CFO and Chief Financial Actuary of Institutional Markets.

Dowrich was born in Canada but was raised in Barbados island, where he went to primary and secondary school and the University of Toronto. He is holding a degree of Honours Bachelor of Science with majors in Actuarial Science and Applied Statistics, as well as an – MBA (Finance) from – Wharton School, University of Pennsylvania.

Dowrich worked at – Credit Suisse before joining Goldman Sachs as Vice President of Risk & the Capital Markets in the – Financial Institutions Group, focusing on capital markets reinsurance.

Dave is a member of the – Society of Actuaries and a Member of the American Academy of Actuaries & is a member of boards of the Entrepreneurial Network – (TEN) Habitat & the – Industry Advisory Council of the Business School at the Medgar Evers College, Brooklyn, New Tork.

In the year 2011, as the main speaker at the inaugural Invest Caribbean conference, he requested the Caribbean region to battle for its global wallet share and stepped up the promotion of its investment story.

Comparing the Caribbean to private firms going public and the need to assure that their story continues being told to their existing & in the future investor base, Dowrich stated that the Caribbean and its leaders must see investment in a similar strain.

Latest

- St. Kitts and Nevis hosts 50th CARICOM Heads of Government Meeting

-

Dominica: Parliament reviews five key bills to strengthen healthcare and governance -

Trinidad and Tobago: Guyanese gardener kidnapped and taken to Venezuela -

Saharan Dust surge triggers Air Quality alert in Antigua and Barbuda -

PM Terrance Drew confirms over 95% of CARICOM Leaders to attend 50th Summit

Related Articles

25th of February 2026

24th of February 2026

24th of February 2026

23rd of February 2026

23rd of February 2026

23rd of February 2026